Anything forced comes back to bite you.

Over-accelerated businesses often go into a shock or paralysis, when the financials show the debt is rising faster than they can finance it. Many go through this. They try to grow too fast by accumulating debt so they don’t dilute equity. There are no shortcuts.

Zynga was an entertainment company that made games for Facebook and Mobile Devices. Even though they earned $90.5 million in a year, they tried to grow too big too fast. Their downfall came when they didn’t stop spending on parties, events for gaming, and free alcohol.

Reading this passage from Morgan Housel sealed it for me:

Tire Tycoon Harvey Firestone writes: It does not pay to try to get the business all at once. In the first place, you can’t get it, so a good deal of your money is thrown away. In the second place, if you did get it, the factory could not handle it. And in the third place, if you did get it, you could not hold it. A company that gets business too quickly acts just about as a boy who gets money too quickly.

You cannot force the nature of things. People have tried for centuries, only to be smacked across the face by nature itself.

One doesn’t get what they want just because they want it. If you did get it, you won’t be able to sustain it. For this reason only, major heirs don’t do that well when taking over the family business. They fall prey to the simple mental fallacy: Just because you saw it doesn’t mean you know it. Just because you know it, doesn’t mean you understand it.

Problem of Scale

There’s a concept called Economies of Scale. It means that as a company grows, so does its revenue. And with it, their expenses increase, and debt increases along with their asset base. Everything is balanced, eventually. What Zynga and most companies make mistakes in is growing too much of a debt base.

Debt is a good thing only if you know how to use it. If you have a credit card with a 15K limit, you can either spend more than you have or remember what you have. Because the chickens come home to roost and debts have to be paid back. When companies and businesses grow too fast, they use up debt and the cash reserve. Then they can’t pay back the debt. Share price goes down, the revenues go down, and again share price goes down. The cycle begins.

When starting in job, business, family, or anything, remember what Morgan says:

It is so easy to overlook how powerful it can be to take something small and hammer away at it, year after year, without stopping. Because it’s easy to overlook, we miss the key ingredients of what caused big things to get big. How can most of Buffett’s success be attributed to what he did as a teenager? It’s so crazy, so counterintuitive.

Most simple things are overlooked. Don’t try to jump to the first floor when you can just take the stairs. Don’t be hasty when going slow but confidently wins the game. Morgan continues:

And since it’s crazy and counterintuitive we overlook the right lessons. So we write 2,000 books on how Buffett sizes up management teams when the biggest and most practical takeaway from his success is, “Start investing when you’re in third grade.”

You cannot force the nature of things.

Look for Trampoline

Imagine a time before the trampoline was invented. The circus was different with people running, instead of jumping and landing safely from trampoline to trampoline. Now imagine a watermelon being thrown at the trampoline from a height. It will bounce back. If there were no trampoline it would splash across the concrete. If a human being was jumping—in the circus— for the first time and didn’t have the trampoline… it would meet the same fate as the watermelon.

The higher the watermelon without the safety of a trampoline, the worse the damage of the splash across the concrete. Now doesn’t that mean that you cannot get high and fly?

Yes and no. You can get higher naturally. Remember that nothing happens for a long time and then everything happens all at once. Think of the ice beginning to melt with one additional unit of degree temperature. An elephant needs only twice its height to fall and make the same splash that a normal human would make if he fell from the top of Empire State.

Instead of the common belief, the bigger and stupider they are at evolving with change, the harder they fall. And splash.

Don’t Overlook the Exponent

In a speech, Charlie Munger explained the Lollapalooza Effect.

What it meant was more than one factor came together to affect the outcome that occurred. When considering the factors that cause downfall, it is never just one thing. Enron wasn’t filing for bankruptcy just because of bad debt. Just like Zynga is not out of business just because of free alcohol in their events.

This rather self-help concept applies to more than the self. Even businesses, those that are successful apply this. Sustained growth is given more importance than just fast and accelerated growth.

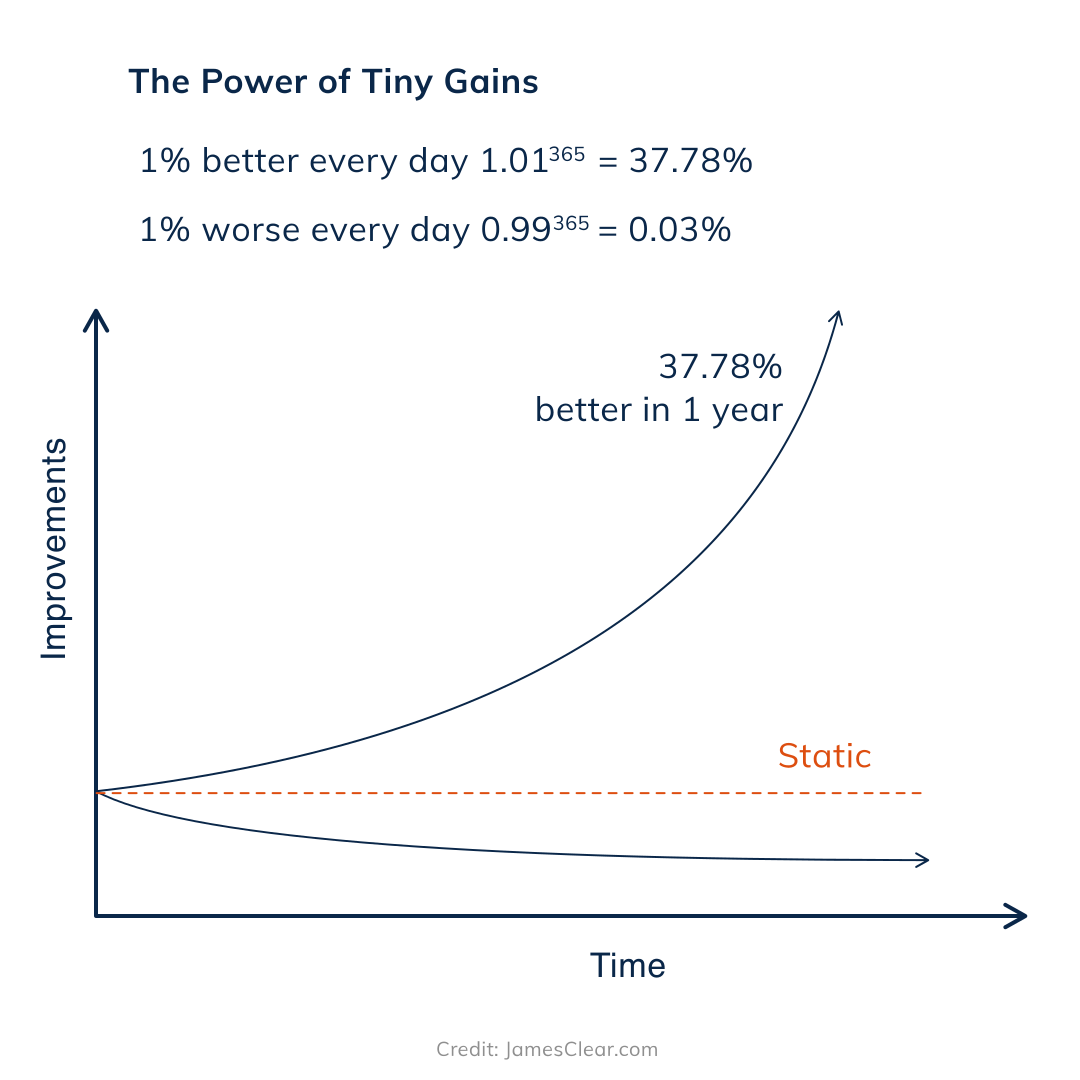

The power of the exponent goes both ways. If you add 2 ten times, it’s 20. But if you multiply 2 by 2 ten times, it’s 1,024. Hammering away at it, as Morgan Housel puts it, is equivalent to multiplying instead of adding. The exponent in a compounding effort gives more benefit if only you wait and keep the intentional action going.

All you have to do is hammer away at it.

The Nature of Things

So what do we make of the nature of things?

The answer might lie with what Emerson said of Nature: Whatever we do, the nature of working or living, is there to serve us. One can say that servitude is to attain peace, to have material wealth, or to have a family. Whatever it is, nature is there to serve us.

But nature forced, always bites back. The world doesn't allow something to go too far too fast. We would be much better off if we looked at shortcuts and forced nature as longcuts disguised as shortcuts.

Sustained growth builds the base stronger than accelerated growth.

Don’t force the nature of things.