More Stuff #4

On feeling smart, details in the reality, Buffett's readings, how its become a lunatic following, and why credit cards exist

We went through a market correction in the past few weeks. And with all the earning calls and stock repurchase plans, it is timely to remember this Bezos quote:

‘Look, when the stock is up 30% in a month, don't feel 30% smarter. Because when the stock is down 30% in a month, it's not going to feel so good to feel 30% dumber.' — Jeff Bezos

1) Reality Has A Lot More Detail Than We Think:

More often than not, we don’t understand something. We may know about it. But we don’t fully understand it, yet.

We all suffer from overconfidence bias to some extent. We overestimate the extent to which we understand reality. This leads us to hold more extreme and overly simplified beliefs about how the world works.

Even after that, we keep going with a simplified view of the world around us. That’s fair. The world is too complex for us to keep track of everything, all at once. So we decide where our attention goes and act on the information we receive. But what happens when we become too confident in our simple view of the world?

It is also something that plays out in our everyday lives. Investors saving for their retirement often get overconfident and fail to appropriately diversify their portfolios. Many people planning to retire in 2008 or 2009 ended up having to work another decade or more because their savings had been cut in half just as they were about to retire.

One way to deal with it is to follow our grandmother’s advice: Hope for the best but prepare for the worst. A good amount of savings is when it feels too excessive. The more complex a system, the more margin of safety is needed for us to cope with the bad times.

The article discusses how we can deal with the complex details of the world systematically.

Written at the end of 2021, this article by Frederik Gieschen still shifts the tectonic plates of my beliefs today.

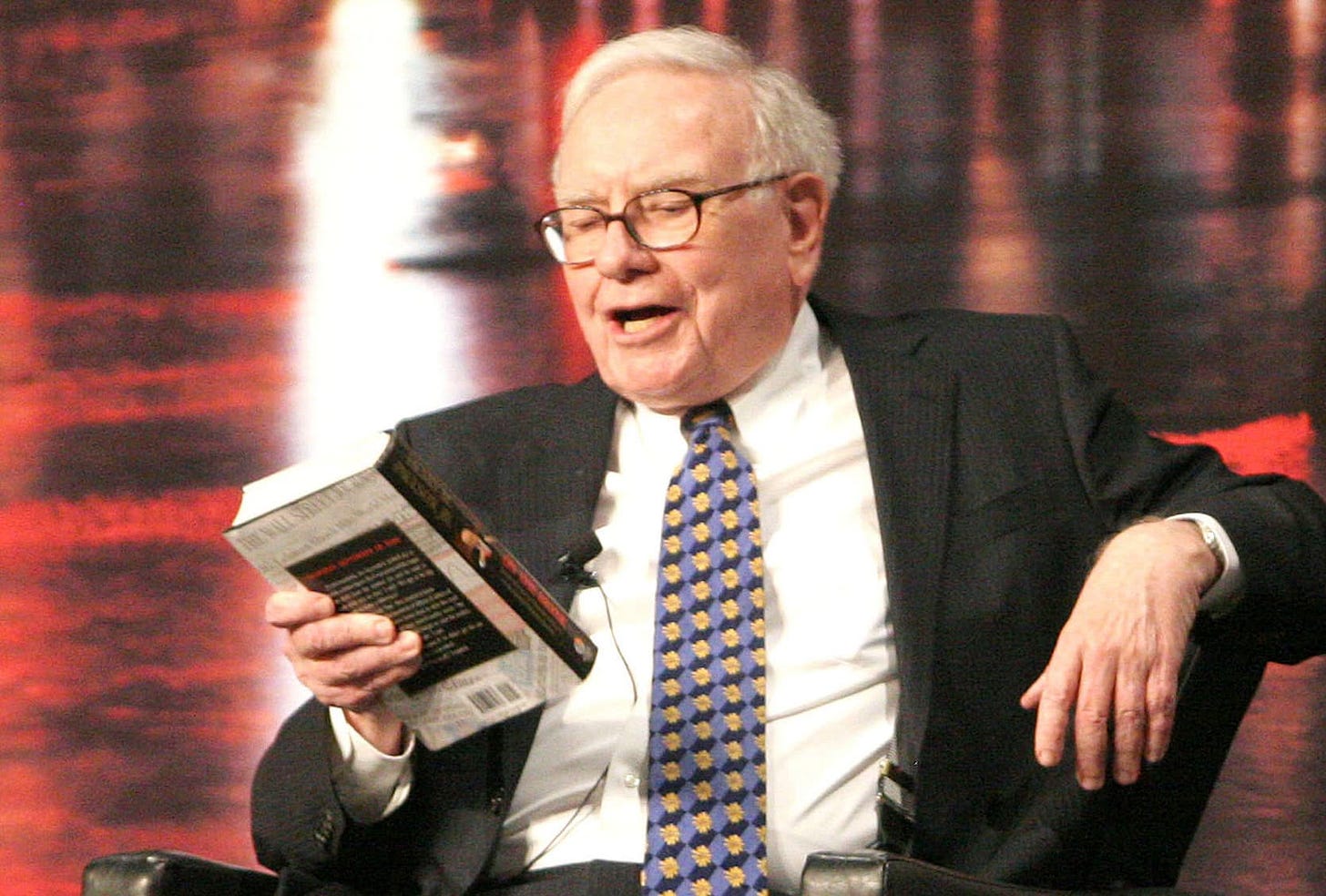

Ask any young investor: What can they learn from Warren Buffett?

Most will answer to read 500 pages a day… And that’s it. I used to think that was the golden key to unlocking the world's hidden treasures. Just Read 500 Pages—a day. I was wrong.

Did a young Buffett read a lot? Yes, he certainly did. Did he spend all his time churning through annual reports, newspapers, books, and trade journals enough? No. Buffett understood how to balance his stack of reading materials with a solid travel schedule. He did not expect to solve the world’s investment puzzles solely from the comfort of his desk.

Most people don’t know about the Buffett Group Meetings. The jet he owns allows him to fly to meet anyone. He had to meet people before people already knew about him. Most people don’t know how he had to hustle his way first to become a household name in corporate America. To end, Fredrik writes:

I’m sure he spends a lot of time reading. But always remember that his wealth was built on the balance of compounding wisdom and relationships. In fact, the two reinforced each other. Go and do likewise.

Cash was used for the longest time until Credit Cards came along. In the Forgotten History of the Credit Cards, author Lynette M. Burrows writes:

Bank Americard devised a publicity stunt that led to the ubiquitous credit card we know today. In 1958 Bank Americard mailed 60,000 credit cards to unsuspecting Californians. It was the rise of the revolving credit revolution.

Starting a revolution that would be so popular that today, 82% of Americans own a credit card. There are 4.4 Billion Visa Cards in the world. Half the world alone uses a Visa Credit Card. However, we can try to have a little experiment for a week.

Only use a predetermined cash for a week.

You might be hesitant to adopt this approach due to the allure of credit card rewards. By choosing to spend more cash at physical locations, you'll accumulate fewer rewards. Many credit cards offer rewards programs, typically around 1-2% on purchases, with occasional 5% bonus categories like gas stations or grocery stores.

Using only cash for payments is a psychological trick that might just boost savings. You can feel your wallet getting lighter. Thinner, even. With each passing purchase, you evaluate the true need and importance of the items you buy.

Thanks for Reading, hope you enjoyed it!

See you next week!

Footnotes:

Image of buffet sourced from here, CNBC.